Analysis

To raise – or not to raise – the duty free allowance

How should governments encourage greater spending within their country’s borders and ensure steady tax income? The Moodie Davitt Business Intelligence Unit’s Min Yong Jung looks at contrasting strategies.

Governments around the world remain perplexed when it comes to deciding the course of action to reign in spending outside of their country’s borders and ensure steady tax income.

With the slowdown in the global economy and the rising tide of geopolitical events affecting domestic economies, choosing the right course of action to persuade citizens to spend within their own countries is becoming ever more important.

Two contrasting policy directions can be seen in Singapore and South Korea. Singapore has increased the Goods and Service Tax for purchases made overseas, while the Korean government has increased the duty free purchase limit from US$3,000 to US$5,000 and is considering raising the duty free allowance of its citizens. This would represent an attempt to encourage more spending in duty free stores prior to and after their travels.

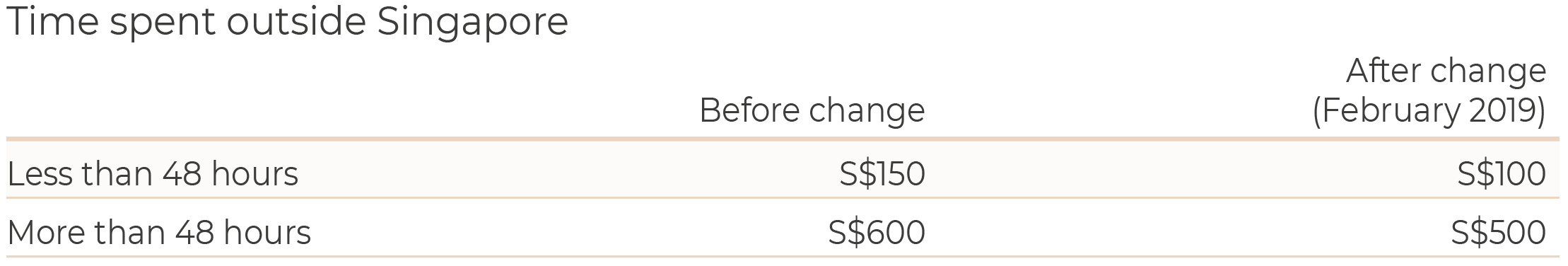

With Singapore recently reducing its duty free allowance from S$600 to S$500 (for travellers who spend more than 48 hours outside of Singapore) and Korea’s review of whether to raise its duty free allowance from US$600 to a rumoured US$800 (National Assembly Member Choo Kyung-ho raised a bill to increase the duty free allowance to this level in June 2019), one has to wonder what the appropriate strategy and the optimal duty free allowance is.

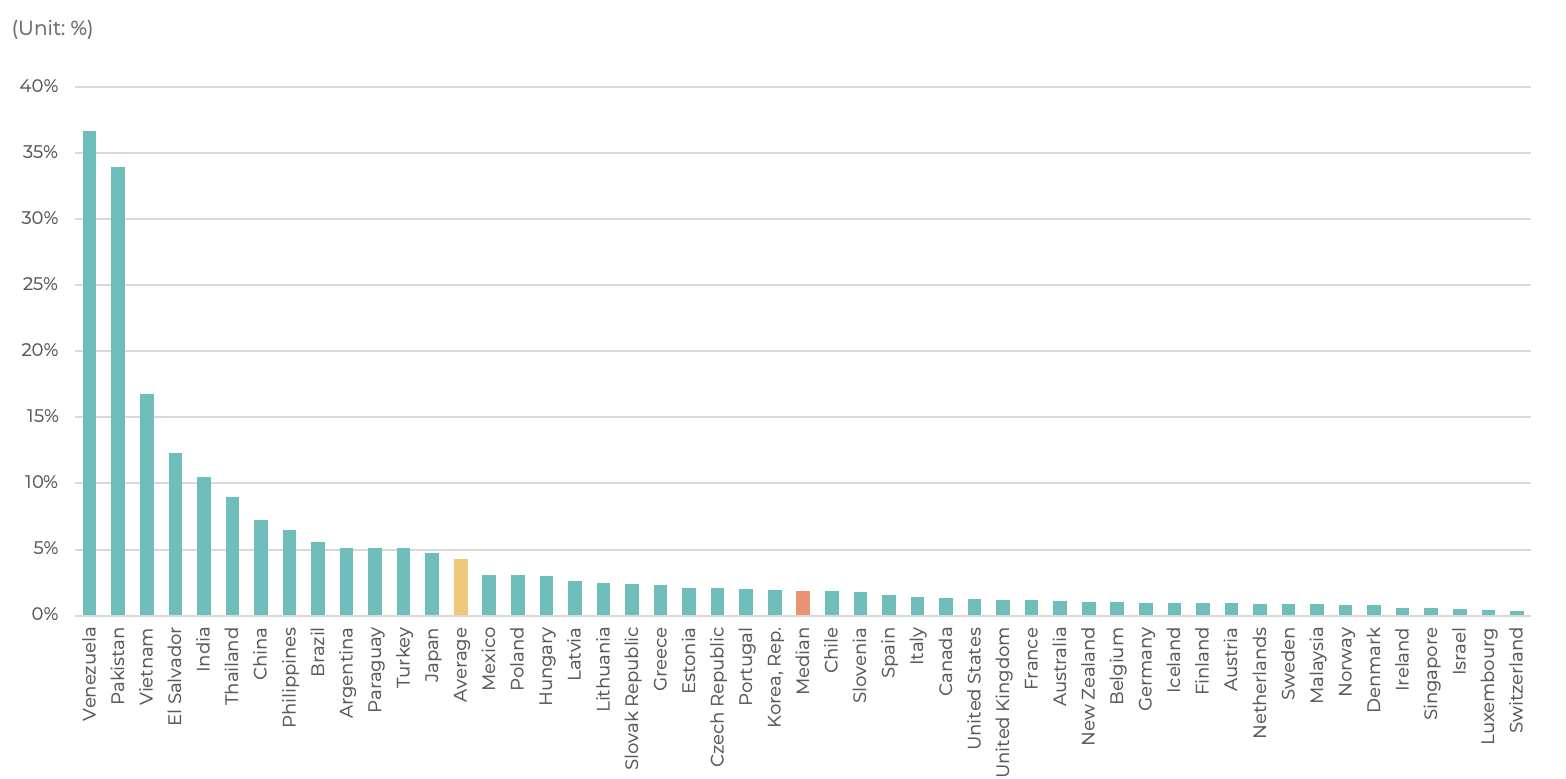

Before any attempts are made to find the right strategy and duty free allowance limit, we will review the current duty free allowance set by countries around the world. The duty free allowance of 49 countries were handpicked and reviewed for this purpose.

Of these, Japan had the highest duty free allowance, with new goods or items intended as a gift over JPY200,000 ($1,861) subject to a 10% duty. Japan’s duty free allowance was head and shoulders above the US$506.7 average of the countries reviewed. As a percentage of GDP per capita, Venezuela’s US$1,000 duty free allowance, which is 36.7% of 2018 GDP per capita at US$2,724, was highest among the 49 countries in our sample. The average of the 49 countries is 4.3% and the median is 1.9%.

Source: Moodie Davitt Business Intelligence Unit

Source: Moodie Davitt Business Intelligence Unit

On 19 February 2019, Singapore’s Ministry of Finance announced a reduction in duty free allowance from S$150 to S$100 for travellers who spend less than 48 hours outside of Singapore and S$600 to S$500 for those who were away for more than 48 hours. Finance Minister Heng Swee Keat announced that the government is reviewing its tax system to ensure that it remains “resilient” amid rising international travel.

* Applicable to Singaporeans, PR and tourists

Source: Inland Revenue Authority of Singapore, Moodie Davitt Business Intelligence Unit

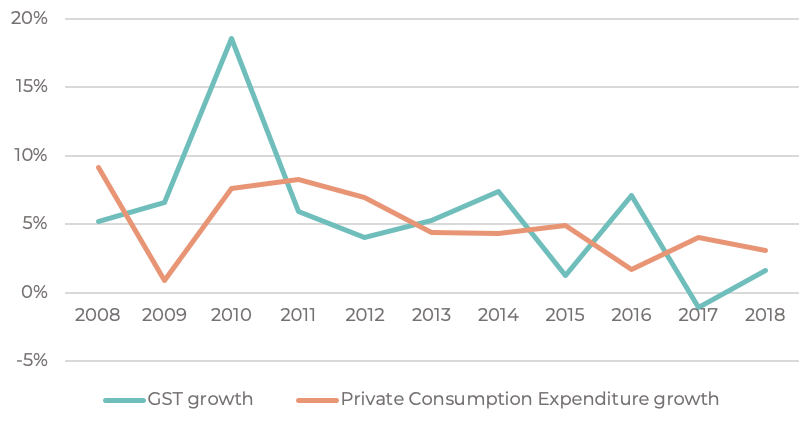

The Inland Revenue Authority of Singapore collected S$52.4 billion in tax revenue for 2018, up +4.4% year-on-year, while goods and services tax grew +1.6% (21% of total tax collection) in line with private consumption expenditure growth of +3.1%. Singapore’s goods and services tax is an important avenue of tax income and as the economy slows (Ministry of Finance lowered its 2019 economic growth forecast from 1.5~3% in May to 1.5~2.5% and from 1.5~2.5% to 0~1% in August) and with trade decelerating, shoring up tax income from domestic industries such as retail will be key to the government’s expansionary budget (2019 forecast to reach a deficit of S$7.1 billion).

Experts claim the reduction in duty free allowance targets a small segment of the population and the small adjustment is unlikely to result in a material increase in goods and services tax. But the change in policy – as well as enhanced enforcement – will remind travellers to declare their purchases, spend within Singapore and ensure tax revenue as a result of increasing international travel is not lost.

Singapore government’s tax income and personal consumption expenditure trend

Source: Data.gov.sg, Moodie Davitt Business Intelligence Unit

Source: Data.gov.sg, Moodie Davitt Business Intelligence Unit

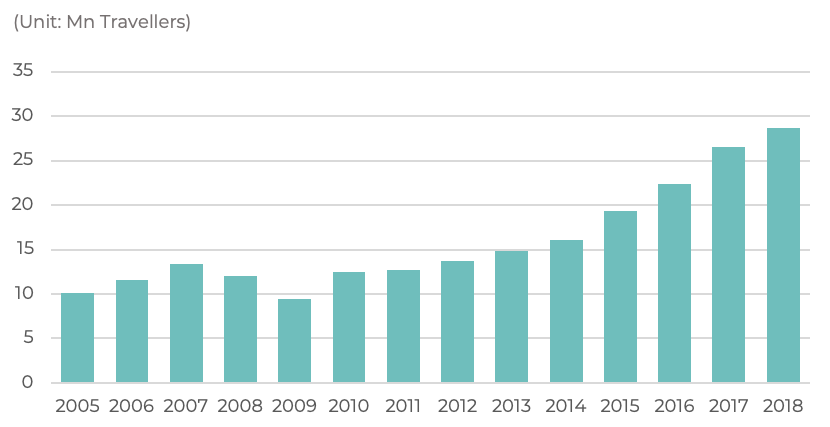

Outbound departures of Singapore residents have increased by CAGR +4.3% from 2011 to 2018 and the steady increase in outbound travel continues into this year with July MTD 2019 growing +3.4% year-on-year.

Several high-profile cases of Singaporean residents arrested at Changi Airport for failing to declare luxury goods purchased overseas shows the level of concern Singaporean authorities have regarding domestic spending and potential tax income being lost overseas.

In January 2018, a 25-year-old Singaporean woman was arrested at Changi Airport for failing to declare S$11,000 worth of luxury goods and a 42-year-old Singaporean woman was fined more than S$32,000 for failing to declare branded goods purchased in France.

Korean government’s economic situation and personal consumption expenditure trend

The slowdown in economic growth and the constant lowering of the economic growth forecast in Korea is much like that of Singapore. The Organisation for Economic Co-operation and Development (OECD) lowered Korea’s economic growth forecast from 2.8% in November 2018 to 2.4% in April 2019 and again to 2.1% in September 2019. Koreans are scaling back spending on overseas travel with lowered consumer sentiment, higher housing prices and a weak economic forecast weighing on outbound travel, which more than doubled from 2010 to 2018.

Korea outbound travel

Source: Korea Tourism Organization, Moodie Davitt Business Intelligence Unit

Repatriating overseas private spending by residents remains a key policy objective of the Korean government, who reserved a special section in its H2 2019 Economic Policies briefing for a means to increase domestic demand. Details in the Korean version of the H2 2019 Economic Policies brief translate as ‘induce conversion of overseas consumption back to Korea’ and a key measure to be deployed was an increase in the duty free purchase ceiling for Koreans.

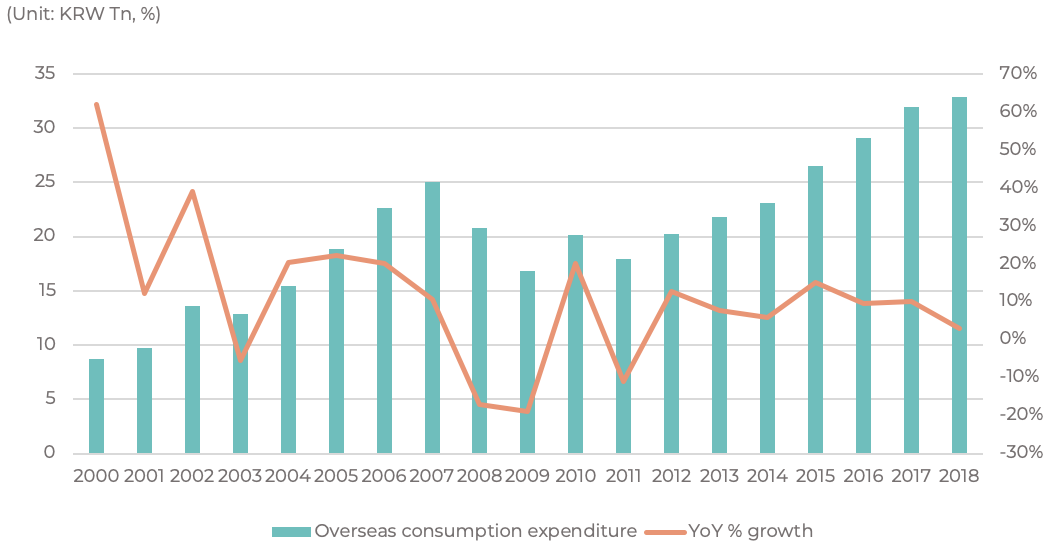

Overseas consumption expenditure has grown from KRW8.7 trillion in 2000 to KRW32.9 trillion in 2018; the growth rate of overseas consumption expenditure has outpaced the growth rate of domestic consumption expenditure but shows extreme volatility and steep downward slopes in times of economic distress.

Growing concerns and lowered consumer sentiment resulted in 2018’s overseas consumption growth coming in lower than domestic consumption growth (2.96% year-on-year compared to 2.97%) for the first time since 2011 when the global financial crisis wreaked havoc on Korea’s economy. While overseas spending growth has slowed, the government remains keen on repatriating consumption spent overseas.

Source: Bank of Korea, Moodie Davitt Business Intelligence Unit

Source: Bank of Korea, Moodie Davitt Business Intelligence Unit

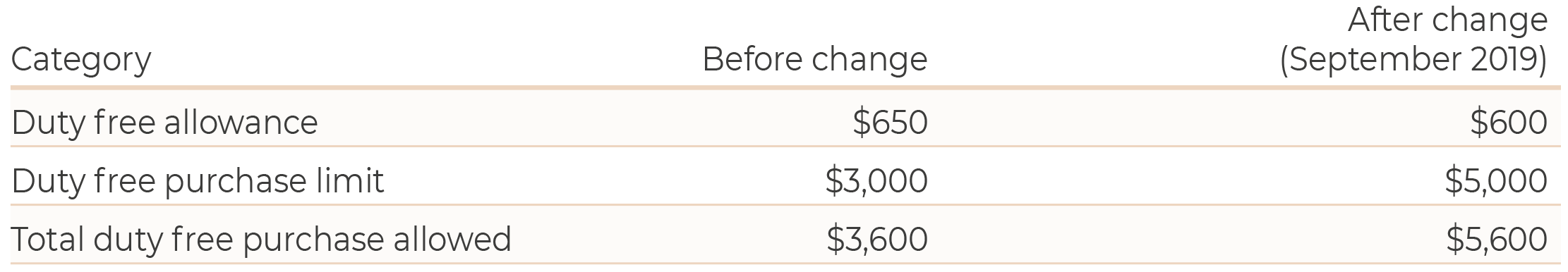

The Korean government announced it would raise the duty free purchase limit of Koreans from US$3,600 to US$5,600 in July 2019 and implemented the change in September 2019. The duty free industry publicly welcomed the change but appealed to the government to raise the duty free allowance. Finance Minister Hong Nam-ki stated that the government would review the performance and impact from opening two on-arrival duty free shops at Incheon International Airport and make a decision regarding the duty free allowance towards the end of the year.

* Applicable to Korean nationals, foreigners have no purchase limit

Source: Ministry of Economy and Finance, Moodie Davitt Business Intelligence Unit

There is no purchase limit for duty free items by foreign nationals but the law restricting purchases by Korean nationals was instituted in 1979 in order to cap spending of luxury overseas products. The duty free purchase limit was set initially at US$500 in 1979 and increased to US$1,000 in 1985, US$2,000 in 1995 and US$3,000 in 2006.

Duty free allowance on the other hand is the amount Koreans and foreigners can bring into Korea tax free. The duty free allowance was initially set at US$125, and rose from US$400 to US$600 in 2014. The increase in duty free spend by Koreans was masked by the explosive growth of high spending Chinese tourists and resellers.

While the duty free purchase limit has increased from US$3,000 to US$5,000, experts predict there will be little impact on duty free spending by Korean nationals because there is no change to the duty free allowance. Korean nationals are given a -30% discount to duties if goods are declared upon entry but this isn’t enough to persuade most Korean nationals to spend more in Korea’s duty free stores prior to departure.

The Moodie Davitt eZine

Issue 269 | 15 October 2019

The Moodie Davitt eZine is published 20 times per year by The Moodie Davitt Report (Moodie International Ltd).

© All material is copyright and cannot be reproduced without the permission of the Publisher.

To find out more visit www.moodiedavittreport.com and to subscribe, please e-mail sinead@moodiedavittreport.com