Analysis

The Moodie Davitt SPEND Index: Flight to ‘safe-haven’ currencies amid COVID-19 pandemic

Welcome to the latest edition of the Moodie Davitt SPEND Index, a platform that tracks currency fluctuations and their consequences and possible impacts on duty free and travel retail trade. This time we focus on how some key currencies have performed amid the COVID-19 crisis. By Max Lazer.

As the COVID-19 pandemic continues to hit societies and economies around the world, the duty free & travel retail industry is facing its worst crisis since it began 73 years ago. Most of the business, with the exception of early recovery in China, has come to a standstill and the outlook for coming months is still unclear. For travel retail, the formula is alarming but simple: no customers means no business.

Given the current extraordinary and unprecedented times, in this edition of the Moodie Davitt SPEND Index we depart from our usual focus on ‘winning’ and ‘losing’ nationalities and destinations. Instead, we focus exclusively on the movements of currencies during the first three months of 2020, when COVID-19 started to spread globally.

In recent months, dramatic and almost daily swings have been seen on the world’s stock markets as well as on oil markets. The world’s foreign exchange markets, trading to the tune of US$6.6 trillion per day, have not been exempt from these heavy fluctuations.

In these times of tremendous turmoil, currency value movements up or down represent proxy battles between nations. It is a different dynamic to last year when most economies were booming, and when some states sought to weaken their currencies to stimulate exports, shrink trade deficits and reduce debt burdens.

Today, countries and their central banks are attempting to beef up the value of their currencies in order to win the ‘currency war’, enabling them to boost funds (especially in US Dollars as well as in other ‘safe-haven’ currencies) to meet debts and liabilities. In The Moodie Davitt Report currency basket, prepared for this Q1 2020 report, no less than nine currencies show increased strength in their value, while only six have weakened.

That basket, comprising 15 of the world’s most common currencies used in travel retail, saw the Japanese Yen appreciate by +30.7% against the Brazilian Real in Q1; the US Dollar gain +27.8% against the Russian Ruble and the Swiss Franc strengthen a significant +15.9% versus the Australian Dollar. And all this during just 65 days of trading.

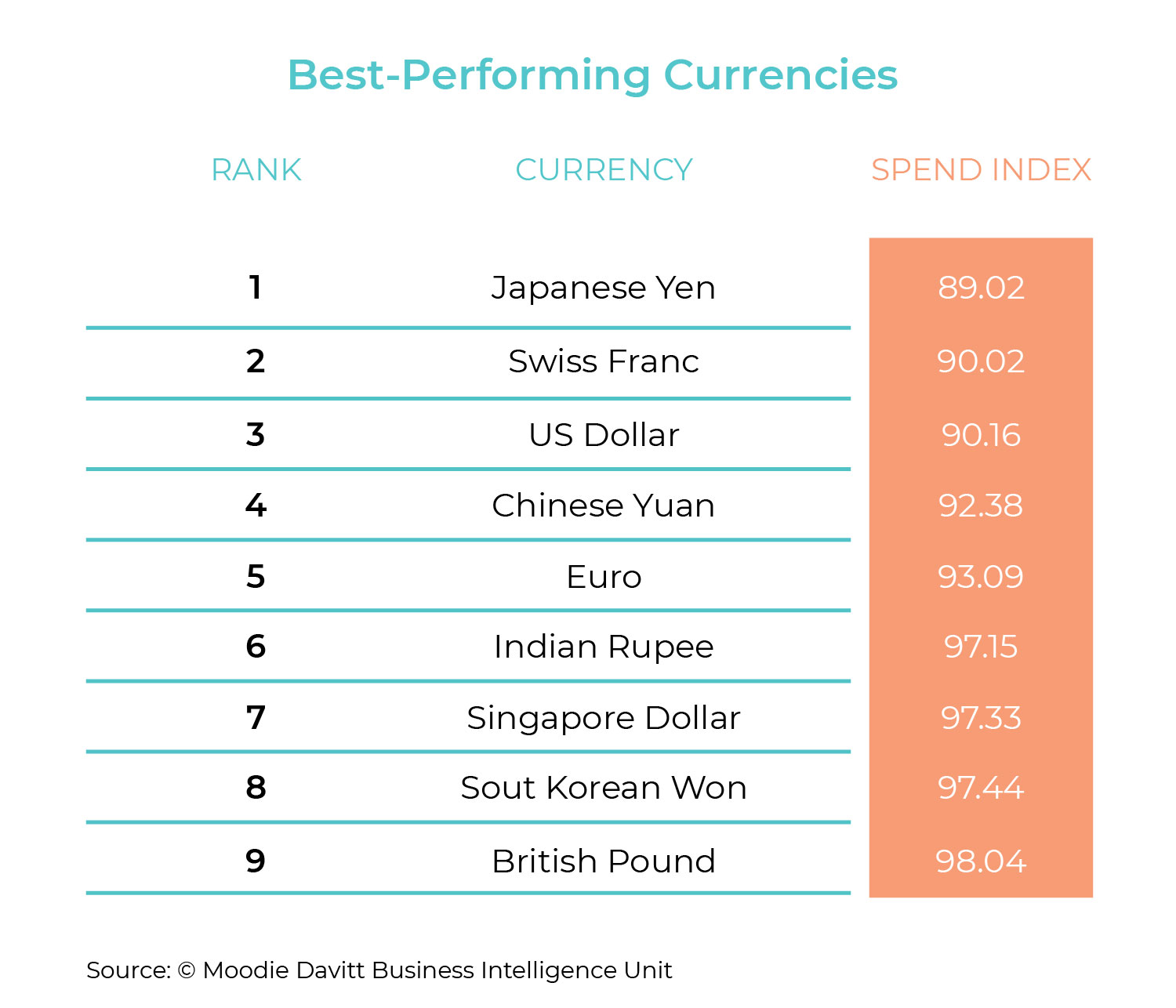

The top nine currencies in Moodie Davitt’s currency basket that have gained the most in value between 31 December 2019 and 31 March 2020 are listed right.

A SPEND Index of less than 100 (“Winners”) indicates that this currency and the spending power of holders of this currency have improved over the past three months. Likewise, a SPEND Index greater than 100 (“Losers”) indicates that this currency and the nationalities owning it has weakened in the recent quarter.

The big winners at the start of 2020 are three ‘safe-haven’ currencies: the Japanese Yen, the Swiss Franc and the US Dollar. A ‘safe-haven’ currency offers protection in times of market volatility and downturn.

In the first quarter of 2020, no currency could match the gain of the Japanese Yen (rank number one, SPEND Index 89.02, gain +11.0%). A basket of products in a travel retail shop that cost on average JPY100.00 on 31 December 2019 only cost JPY89.00 on 31 March 2020. The appreciation of the Japanese Yen against the 14 other currencies in the currency basket comes to +11.0%.

As there are no domestic issues that would explain the Yen’s strengthening, the COVID-19 pandemic is the sole reason for the Yen’s gain as it has driven investors to safer assets.

The second biggest gain three months into 2020 came from the Swiss Franc (SPEND Index 90.02, gain +10.0%). Known as a ‘safe-haven’ investment currency as Switzerland is rated as one of the safest economies in the world, around 30% of all offshore funds are banked in Switzerland.

The US Dollar (rank number three, SPEND Index 90.16, gain +9.8%) has been rising steadily too. During the first quarter, the US Dollar Index (an index of the value of the Dollar relative to a basket of foreign currencies) reached a three-year high as investors flocked to this trusted ‘safe-haven’.

A SPEND Index at 90.16 means that the US currency is now worth on average (against the other 14 currencies in the basket) +8.8% more than at the end of 2019. The US Dollar is the world’s leading reserve and trading currency as is typically sought after in times of crisis. This has led to a shortage of US Dollars on the world’s financial markets resulting in a liquidity problem which has magnified the strengthening of that currency. In ‘normal’ times, the strong US Dollar would be a win for Americans travelling abroad who now can shop at an effective average discount of -8.8% compared to the beginning of the year.

It may come as a surprise that the Chinese Yuan (rank number four, SPEND Index 92.38, gain +7.6%) has strengthened over the past three months. This is potentially good news for the travel retail industry for two reasons. Firstly, among all the countries affected by COVID-19, China is likely to be one of the earliest major source markets of tourism to recover with China’s own so-called ‘domestic duty free shops’ located on Hainan Island among the first to rebound.

Secondly, the Chinese are the leading spenders by nationality in the world’s duty free & travel retail shops. A continued strong Yuan will boost the appetite of the Chinese to travel and spend once they can fly in large numbers beyond their own shores.

Additional currencies that have strengthened at the start of 2020 include the Euro (+6.9% on average), Indian Rupee (+2.8%), Singapore Dollar (+2.7%) and the South Korean Won (+2.6%).

Completing the Top 9 list of winning currencies is the UK Pound (SPEND Index 98.04, gain +2.0%). The Pound has, however, been through a rocky road in Q1 2020 and in the quarter hit a 35-year low against the US Dollar, when as little as 1.15 US Dollars bought 1 UK Pound. The country still has to negotiate a post-Brexit deal with EU at the same time that it has to deal with a devastating economic fallout as a result of the COVID-19 outbreak. These factors cause some investors to view the UK currency as being ‘risky’.

The Brazilian Real and the Russian Ruble stand out as the two big losers in currency terms during the COVID-19 outbreak in Q1 2020. Among all the world’s 165 currencies traded on a daily basis, apart from the Venezuelan Bolivar, the Brazilian Real is the world’s poorest performing currency so far in 2020.

On 31 December 2019 4.02 Brazilian Reals fetched one US Dollar. Three months later on 31 March 2020, no less than 5.20 Reals were needed to buy one US Dollar. The depreciation of the Brazilian Real can partly be blamed on the COVID-19 outbreak and the already visible disastrous impact it has had on the Brazilian economy.

The Brazilian Central Bank has several times stepped in to support its currency, so far to no avail. According to currency traders, further possible interest rate cuts to reduce borrowing costs will send the Brazilian currency even lower.

With a Spend Index at 115.51, the Russian Ruble has lost -15.5% of its value and SPEND Power on average compared to the start of the year. The Ruble has been especially hard hit after Saudi Arabia and Russia in March failed to agree on new production limits of oil, opening the way to an outright oil price war. The flood of oil that emerged was met with a collapsing demand because of the outbreak of COVID-19, which hurt the Ruble even more.

As reported, for the full year of 2019 no other major currency could match the strengthening of the Russian Ruble (+10.3%). Now, three months into 2020, the Ruble is the second biggest loser in currency terms. This remarkable development exemplifies the current volatility in the currency market.

The Australian Dollar (rank number three, SPEND Index 106.10, decline -6.1%) slumped at one time in the first quarter to a 17-year low against the US Dollar. The Aussie Dollar is highly correlated to the Chinese economy and that country’s demand for especially coal and iron core.

As it will take some time for the Chinese economy to recover, there are fears that this demand will weaken, negatively affecting the valuation of the Australian Dollar. Other recent negative factors included the bushfires that plagued the nation for several months in 2019 and into 2020.

The New Zealand Dollar (rank number four, SPEND Index 104.57, decline -4.6%) has been falling since the start of the year among fears that COVID-19 would affect New Zealand more than other countries. Recent developments show, however, that New Zealand has managed the COVID-19 disease better than most. This suggests a potential future strengthening of the New Zealand Dollar although the country still has to deal with low inflation rates and, amid COVID-19, worsening business sentiment including those relating to the vital tourism and travel retail sectors.

In 2019 the Thai Baht (rank number five, SPEND Index 101.65, decline -1.7%) appreciated in value throughout the year in a significant and sustained manner, which caused alarm in government and business circles, mostly among exporters. The strong Thai Baht in 2019 hampered exports and put a lid on important tourism revenues, including duty free. Given that perspective, the weakening of the Thai Baht in Q1 2020 – including -8.2% versus the Chinese Yuan – is probably welcome news for Thai businesses.

The Canadian Dollar (rank number six, SPEND Index 100.56, decline -0.6%) shows a marginal loss of -0.6% in the first quarter of 2020.

The SPEND Index also studies the fortunes of 210 currency pairs.

Each currency pair, including the base currency and the target currency, all had the nominal value of a SPEND Index 100.00 at the start of 2020 (31 December 2019).

The table above shows 50 value indicators for the SPEND Index as it includes both the winning base currencies and, at the same time, the losing target currencies.

Based on exchange rates valid on 31 March 2020 and 31 December 2019 and comparing those it is possible to examine and document the level of change in SPEND power of each currency in the currency pairs. The SPEND Index indicates in the column headed ‘Base Currency’ how much of the base currency is needed on 31 March 2020 as compared to 31 December 2019 to buy 100 units of the target currency. It also reveals how much of the target currency is required to buy 100 units of the base currency (in the column to the far right, ‘Target Currency’).

At rank number three in the table above we find the currency pair the Japanese Yen and the Australian Dollar. The SPEND Index for the base currency the Japanese Yen is listed as 83.02. This effectively means that at the start of 2020, nominally 100 units of the Japanese Yen were required to buy 100 units of the Australian Dollar. Three months later, only 83.02 Japanese Yen were needed to buy 100 Australian Dollars. This number corresponds directly to the level of appreciation of the Japanese Yen versus the Australian Dollar during the three-month period, coming to +17.0% (100.00 minus 83.02, rounded to one decimal).

In a similar manner for the same currency pair, the SPEND Index for the Australian Dollar is shown as 114.51. At the beginning of 2020, nominally 100 Australian Dollars fetched 100 units of the Japanese Yen. At the close of the first quarter, 114.51 Australian Dollars were required to by 100 units of the Japanese Yen. Again, this is equivalent to a depreciation of the Australian Dollar against the Japanese Yen of -14.5% (100.00 minus 114.51, rounded to one decimal) during the period. Similar interpretations can be made for all currencies in the currency pairs listed in the table above.

One quarter into 2020, all currencies in the Moodie Davitt currency basket made gains against the Brazilian Real (rank number one, SPEND Index 79.29, average gain +20.7%).

All currencies also show gains (except the Brazilian Real with a loss of -1.0%) against the Russian Ruble (rank number two). On average all currencies record a gain of +18.9% corresponding to a SPEND Index at 81.09. Similarly, the Russian Ruble has lost -15.5% on average to all currencies in the basket (SPEND Index 115.50). The currencies against which the Russian Ruble shows losses are not listed in the table but include the Japanese Yen (-22.2%), the US Dollar (-21.7%) and the Swiss Franc (-21.6%).

The Australian Dollar is listed as the losing target currency at rankings number three, four and five. Against the Japanese Yen the Australian Dollar has lost -14.5% (SPEND Index 114.5), on the Swiss Franc -13.7% (SPEND Index 113.71) and versus the US Dollar -13.6% (SPEND Index 113.60).

Amid the crisis, currencies and exchange rates will continue to fluctuate, fascinate and occasionally frustrate.

The Moodie Davitt SPEND Index analysis embraces 210 nationality and country of destination pairs, as well as 15 averages each for nationalities and destinations (= 240 x value indicators). It will continue to monitor the consequences and possible impacts of currency fluctuations on duty free and travel retail trade in the months ahead.

The Moodie Davitt eZine is published 12 times per year by The Moodie Davitt Report (Moodie International Ltd). © All material is copyright and cannot be reproduced without the permission of the Publisher. To find out more visit www.moodiedavittreport.com and to subscribe, please e-mail sinead@moodiedavittreport.com