Insight

Embracing growth

The 2018/19 Airport Commercial Revenues Study emphasises the growing importance of F&B in airport retail programmes, says report author and MD of The Mercurius Group Ivo Favotto

Photo: Fortnum & Mason at Heathrow T5

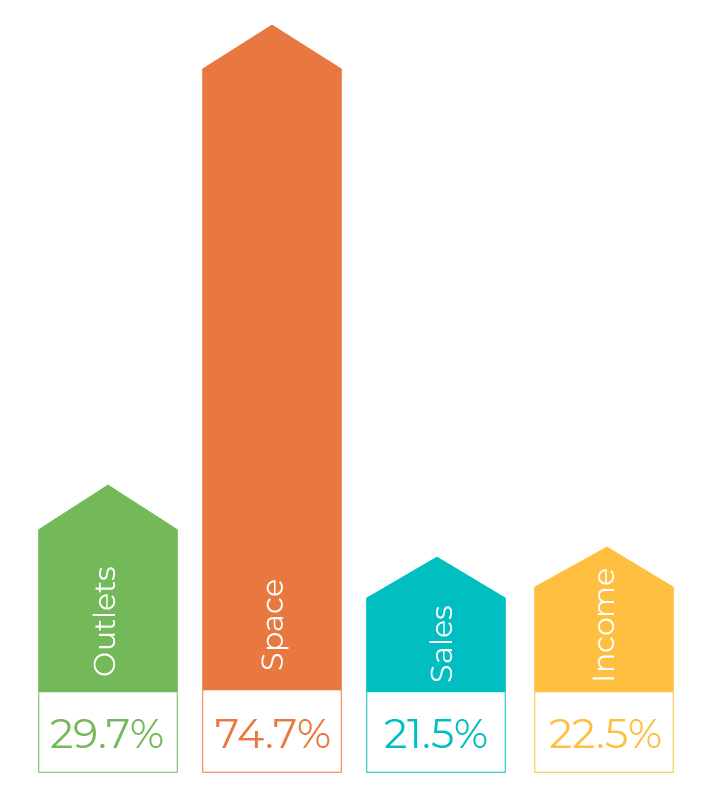

The recently released 2018/19 Airport Commercial Revenues Study (ACRS) – published by The Moodie Davitt Report and The Mercurius Group – highlights the growing importance of F&B in airport retail programmes. F&B now accounts for 21.5% of all retail sales on airports (inclusive of duty free, specialty and currency change) and 22.5% of all retail income for airports.

The growth in the importance of F&B is particularly significant in Europe and Asia Pacific – where the strength of duty free and specialty retail has always been apparent. In North America by contrast, F&B always has been and continues to remain strong for large numbers of airports.

“This greater segmentation of F&B offers has allowed the sector to grow both penetration and average transaction values, leading to its growing contribution to Passenger Spend Rates”

From an airport perspective, while F&B’s share of sales and income has been growing, so too has the amount of space that it utilises. F&B now accounts for around three-quarters of all retail space in airport terminals (including leased seating but not including common F&B seating areas such as food courts or in gate areas).

F&B Share of Airport Retail Programmes

The mismatch between F&B’s share of space and share of sales and income remains therefore as one of the main inhibitors and challenges to the sector’s growth. Moreover, the challenge for airports is how to embrace the growth of F&B while minimising any cannibalisation impacts on other retail formats – or indeed using F&B to grow the penetration of other retail formats, a balance which requires careful and detailed planning.

The growth of F&B at many airports has been driven by increased segmentation of food offers around food quality, level of service, cuisine styles, time-of-day, price positioning and of course taste-of-place (i.e. providing more cuisine from the region, including well-known local and tourist concepts from downtown).

This greater segmentation of F&B offers has allowed the sector to grow both penetration and average transaction values, leading to its growing contribution to Passenger Spend Rates (PSR).

The 2018/19 ACRS also segments its findings into three outlet types:

- Quick Service Restaurants (QSRs)

- Food Court Outlets (FCOs)

- Other (mostly bars, cafes and casual dining outlets)

QSRs play an important role in the F&B programme of many airports, accounting for 40% more of total F&B sales than they do outlets. That said, while QSRs are obvious sales generators, they under-contribute to airport income, with their share of income being 28% less than their share of outlets. So, while lower yielding, QSR outlets tend to perform well in airport income per square metre terms.

Source: 2018/19 Airport Commercial Revenues Study

“By far the most commonly requested F&B data from the 2018/19 ACRS is the data we provide on F&B yield”

The largest element of F&B programmes across the board are ‘other outlets’ – dominated by bars, cafes and casual dining outlets. These other outlets account for over three-quarters of all airport F&B outlets and around two-thirds of sales. However, these tend to be the highest-yielding outlets and so contribute strongly in income per square metre terms.

The 2018/19 ACRS also provides data on F&B sales and airport F&B income in both per passenger and per square metre terms. This data is provided by airport size (<10m pax, 10-30m pax and >30m pax) and by region (Europe, Asia Pacific and The Americas) and is typically used by airports, retail planners and architects planning terminal expansions or developments.

But by far the most commonly requested F&B data from the 2018/19 ACRS is the data we provide on F&B yield. Everyone wants to know how much rent is paid – whether it is to provide benchmarks for business case development or benchmarks used as inputs into tender bids/contract negotiations.

The 2018/19 ACRS segments yield data in three ways:

- By airport size

- By region

- By F&B outlet type

This granularity of detail helps planners, developers, airports and concessionaires alike. It is also typically used by investors and financiers who want to know that they are getting a good deal or whether there is any commercial upside in an acquisition.

Other outlets (bars, café ad casual dining) generate the highest percentage rents, while QSR outlets generate the lowest.

The Mercurius Group has recently been involved in several major terminal developments, including F&B expansions, all the way from concept development to tender management/leasing.

Having been involved in such developments around the world over the past 30 years on a Trinity basis (i.e. as landlord, as concessionaire and as planner/adviser), we can honestly say that the level of interest and the quality of responses received has been unprecedented. This motivates airports to find/create more space to allow even further innovation in F&B – which of course continues to drive growth in sales and income for airports and concessionaires alike.

For more details or to purchase the 2018/19 ACRS, please contact Victoria Willey on Victoria@MoodieDavittReport.com

* Ivo Favotto is the Managing Director of The Mercurius Group and author of the 2018/19 Airport Commercial Revenues Study, published by The Moodie Davitt Report. The Mercurius Group advises airports on the optimisation of their commercial programmes, all the way from project conception and business plan development to design and leasing.

The Foodie Report | 25 June 2019