The Trinity Initiative

Taking the industry conversation forward

The Moodie Davitt Report in association with Bain & Company has taken the first steps in addressing fundamental issues about the future structure of the industry and relationships within it, through The Trinity Initiative. In this special report, we report on progress to date and on the key themes that arose in two recent webinars that kickstarted the industry conversation.

New consumer behaviour, the transformation of shopping environments and the industry commercial model post-COVID-19 are among the central themes being considered as part of The Trinity Initiative, launched in April via The Moodie Davitt Report.

As reported, that initiative aims to identify a range of solutions to key industry questions during and after the crisis. It was introduced with the cooperation of a range of senior industry stakeholders and in association with management consultancy Bain & Company. In parallel, private discussions will be conducted among smaller groups, hopefully accelerating progress through the influence and commitment of the industry’s leaders.

Two webinars to kickstart the initiative took place on 24 April, setting the scene for further discussions ahead, which will culminate in a White Paper. Specific recommendations and findings will also be the subject of a special session during the Symposium at The Moodie Davitt Virtual Travel Retail Expo in September.

The April webinars attracted a strong combined audience of over 200 airports, retailers, brands and other service providers, with high levels of engagement and interaction among participants about the industry’s direction.

Alongside The Moodie Davitt Report Chairman & Founder Martin Moodie, and President Dermot Davitt, speakers included Mauro Anastasi, a Partner with management consultancy Bain & Company Italy and Jack MacGowan, Director at Castlepole Consulting in Ireland and former CEO of Irish state-owned Aer Rianta International.

“It means a transformation of physical infrastructure at the airport, around retail and food & beverage, alongside a reassessment of the price competitiveness of travel retail”

–Mauro Anastasi

The Virtual Kiosk from airport ecommerce platform Grab, which has introduced several new contactless technology innovations. The Virtual Kiosk allows travellers to order from their own device without the need to download an app.

To set the scene for the conversations, they had worked on an important paper headed ‘COVID-19: A New World for Airports’, highlights of which were introduced during the webinars (available here as a link).

They were joined by Eric Trichot, owner of PT&M, who offered a fascinating insight into how several of his client airports are running tender processes amid the crisis (see next page). PT&M works with airports to optimise their commercial activities, frequently structuring and running tenders.

Setting the scene, Martin Moodie said: “We are facing a global crisis like no other – both medical and economic. All the early quite justifiable talk about our sector’s resilience and ability to bounce back quickly and strongly from crisis has been rendered not irrelevant but certainly marginalised by the depth, the ferocious speed and the geographic spread of COVID-19’s impact on the global travel and tourism industry. Airports and airlines are in near shutdown, many national borders closed.

“The Trinity Initiative was born out of numerous approaches to us to reinvigorate the founding principles of the 2003 Trinity Forum – principles based on creating a win/win/win model for three key sector stakeholders (the airport – or the airline or cruiseline), the retailer or food & beverage or other consumer services provider, plus the brand.

“The Trinity Initiative aims to identify a range of solutions to the contractual dilemma faced not only now by airports and their commercial service providers in the wake of minimal or zero traffic but solutions that can underpin an equitable and sustainable model in the future.

“So here is a fundamental question. How can airports best ensure the funding they require from non-aeronautical revenue sources, which we know are so essential to funding crucial infrastructure development and to minimising passenger costs? What is the best way to ensure a ‘win’ for the airports, while ensuring that they still attract the necessary investment and expertise of quality commercial operators and their world-class brand partners?”

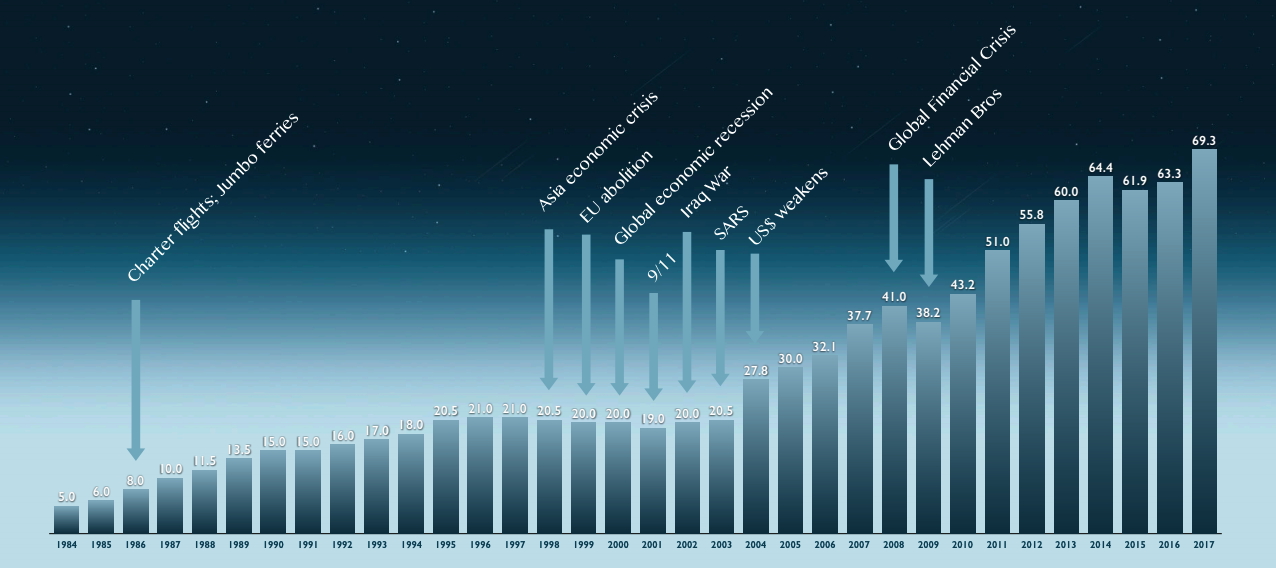

COVID-19 will not be followed by a V-shaped recovery, as other crises were

Global Air Traffic – Billions of Passengers Carried

Source: World Bank

Recovery to take time

Addressing the big picture, Anastasi said: “We [Bain & Company] believe the fundamentals of travelling and travel retail are still valid and will continue in the long-term to be a healthy industry.”

But, he warned: “The issue we are all facing is what happens between now and the long-term; what’s happening is not only a health crisis but a dramatic economic crisis with very deep temporary and permanent effects. Even when the effects of lockdowns are eliminated, there will be a significant GDP reduction (two to three times that of the Global Financial Crisis) and lack of ability for consumers to spend at the same levels for a long period.”

He said that in the face of COVID-19, the world of airport retail is set to change forever. This time, we are unlikely to see the ‘V-shaped’ rebound that occurred after other major crises that disrupted the channel. It will be a long and complex path back to the levels of business that were achieved by the sector during 2019, he added.

Anastasi said: “We believe we will not see passengers at 2019 levels until 2023. 2021 will see something like 75-85% of traffic and 2022 about 85-90% of 2019 numbers. Obviously nobody has the right numbers, as many scenarios can play out, but we are looking at [fewer] passengers for at least three years. Domestic and short haul will recover first, with long haul the last to recover.”

The traditional sector view of great resilience to and ability to rebound rapidly from crisis simply does not hold true in the prevailing COVID-19 situation. As Anastasi noted, this is an external disaster of a magnitude that the modern aviation era has never experienced – from a medical, economic and sector-specific point of view.

Air traffic recovery likely only in the mid to long term

Lit research, Bain analysis

Headlong into a new world

This in turn will mean fundamental change in perceptions of work, travel and shopping around the world.

Anastasi said that the current move to using Zoom and other online forms of communication within companies will result in lower levels of business travel. Companies now realise that travel can actually be replaced in many cases and even when restrictions are lifted, home and online working will stay for cost and indeed health-related reasons.

He said: “It is COVID-19 today but it might be x, y or z [crisis] in three or five years’ time, so companies will think about that. I don’t think this will change the long-term attraction of travel in general, but the way we work will change, because we have seen it can work.”

Another impact is likely to come with the increased use of ecommerce to purchase goods; many people are now buying online for the first time and will probably continue to do so.

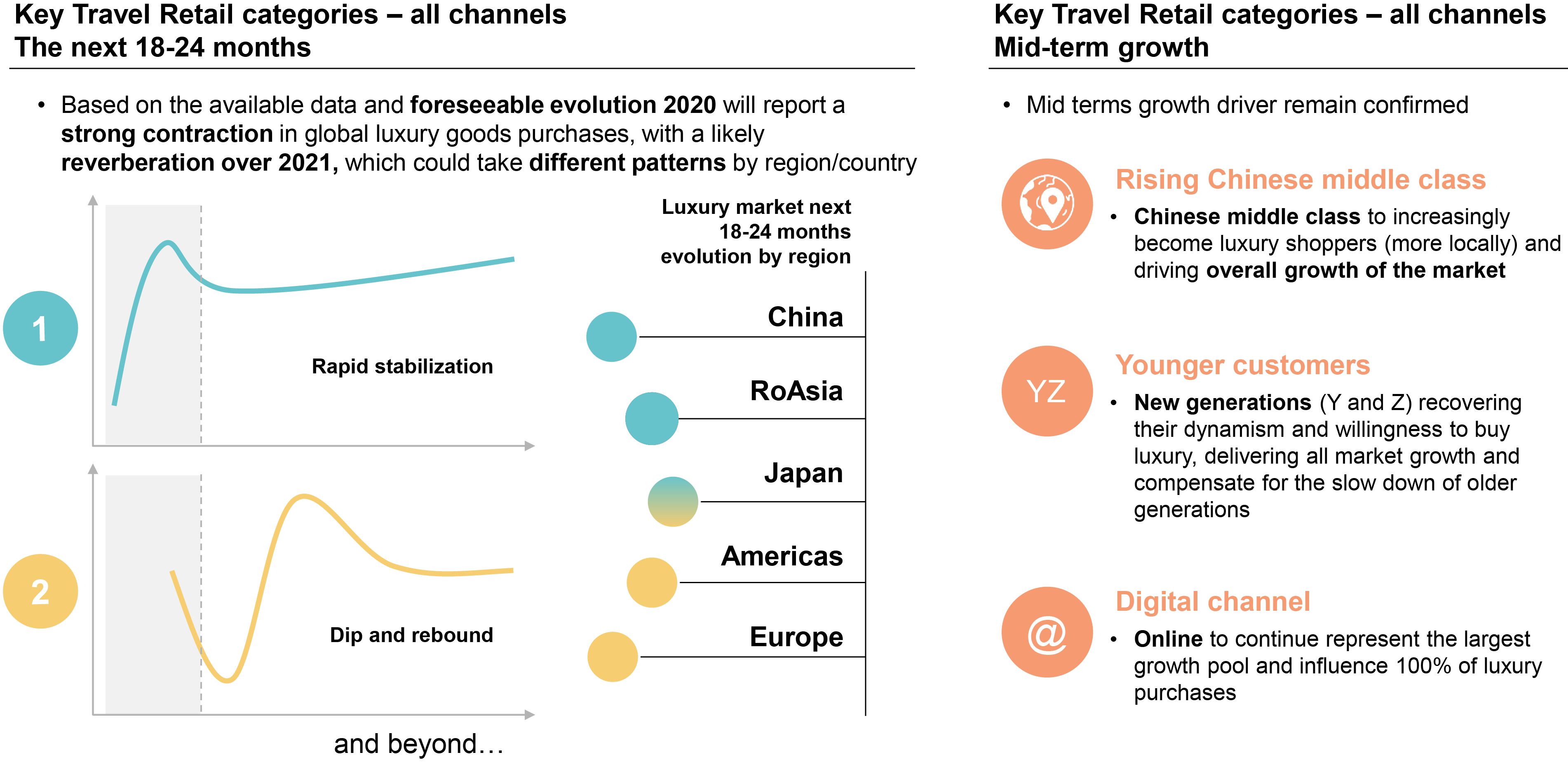

The potential scenario for key travel retail categories...

…with very different categories/brands in the mix

Adapting to the new consumer

The conversation homed in on the twin themes of changed consumer behaviour on one hand, and how the industry will be structured to adapt on the other.

Demand for essentials may replace that for luxury at least in the short term, said Anastasi, addressing a much-asked audience question.

“The majority of growth probably won’t come from luxury and we will probably see a higher weight of non-luxury in the mix. The impact of that will be dramatic in terms of the P&L of a travel retailer, with different gross margin, the rent they can pay and so on.

“Omnichannel can also have practical implications. For example, as we have already seen in China after the downturn, there may be less time spent looking at brands in-store. The shopping mission is becoming kind of an omnichannel mission, meaning you go to a luxury store having viewed online with a clear idea of buying a particular item.”

Duty and tax free sales evolution (US$ billion)

Travel retail performance amid and following previous crises. The chart underlines the historic resilience of the sector. But COVID-19 is a crisis like none that has gone before. Source: Generation Research

Some of that behaviour will transfer to travel retail. “This means the online proposition needs to transfer some of the emotional impact of today’s travel retail into online and it also means the store’s role is very different. In F&B, will we really be queuing up for sandwiches in airports if we can order it online? So before we discuss MAGs, we have to decide what the consumer wants and how we should adapt.

“This also means a transformation of physical infrastructure at the airport, around retail and food & beverage, alongside a reassessment of the price competitiveness of travel retail. That will become even more acute if the reference price of consumers becomes ecommerce and not the physical stores.”

Jack MacGowan noted that the industry should take “a three-year, not a three-month view” of change in behaviour when planning ahead.

“Airports will rightly implement a hierarchy of space based first on health and safety, then operations and only then around commercial needs”

–Jack MacGowan

“We sell things that nobody really needs to people who want to be elsewhere. We have to have trust from the consumer, and need to reinforce that in what we sell, and how we sell.

“For these next three years, we are looking at a very different passenger profile. It will be skewed younger rather than older especially if a vaccine is not yet available. They will have less money in their pockets, and at airports will have to adhere to new standards on social distancing. It could also be a higher cost eco-system. So it will be challenging to continue with the same mix as today.

“Will we need wider walkways? Perhaps. We will need them for the year ahead certainly. Airports will rightly implement a hierarchy of space based first on health and safety, then operations and only then around commercial needs.”

MacGowan was asked at what kind of percentage passenger level should airports expect retailers and food & beverage outlets to reopen.

He said: “It’s very hard to say but if an airport has no retail through the airport system, particularly airside and taking into account the new operation with social distancing, it elongates the dwell time in the airport – there will be a much bigger need for retail and F&B landside than before.

What would shopping look like if you could walk into a store (or F&B outlet), grab what you want and just go? Amazon has the answer (as does, from recently OTG). Expect more of the same in the post-COVID-19 airports of the future.

“It has to be done on a case by case basis. If we have 20% of traffic levels, maybe you have 10% or 20% of the retail space open. But the fundamental problem is what to open? Do you need a luxury Coach or Louis Vuitton store for the first two years? Or would you be better off with three times the space for restaurants, which will need to be bigger for social distancing reasons? Those are the sorts of questions that need to be raised. But it’s driven by the premise that you are trying to make air travel safe – reassuring passengers that it's safe to travel.”

In short, the new world will feature at least partially altered layouts of airport commercial zones; the need to understand and adapt to consumer attitudes quickly; and a need for flexibility in industry relationships compared to before.

The last of these themes was a central point of discussion: how might contractual arrangements be adapted to a new industry order? (Turn to page 7.)

The Moodie Davitt eZine is published 12 times per year by The Moodie Davitt Report (Moodie International Ltd). © All material is copyright and cannot be reproduced without the permission of the Publisher. To find out more visit www.moodiedavittreport.com and to subscribe, please e-mail sinead@moodiedavittreport.com